Get the free ct 8379 form

Show details

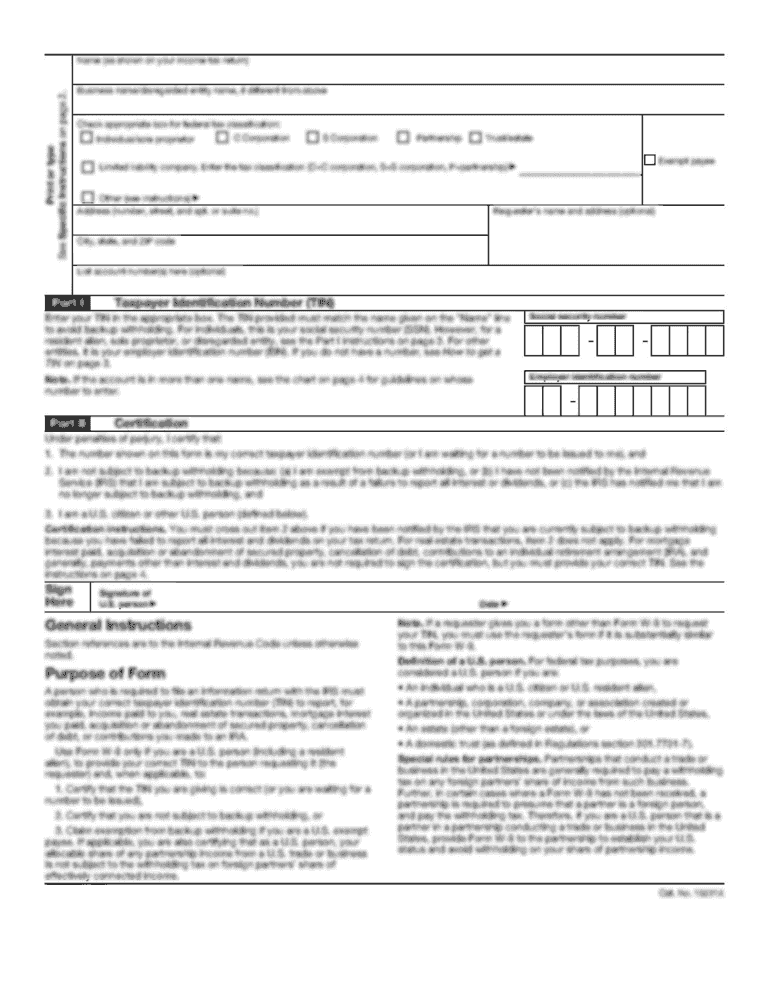

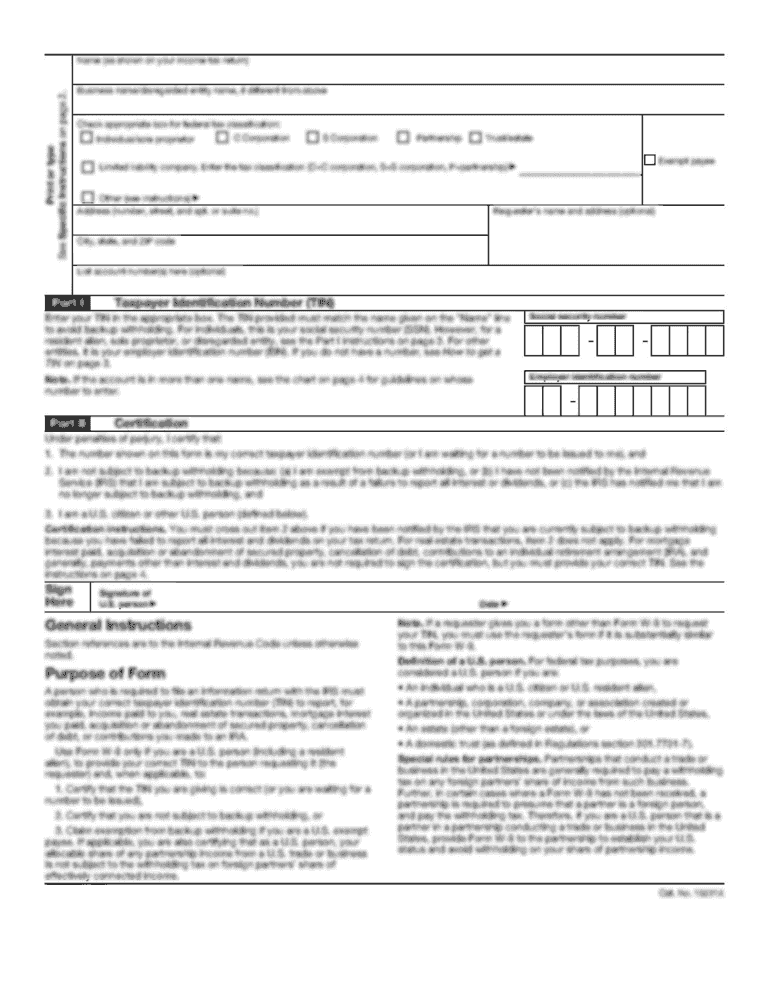

Important Attach copies of all forms W-2 and 1099 showing Connecticut income tax withheld to Form CT- 8379. Filing the Return You must file Form CT- 8379 with Form CT-1040 Form CT-1040EZ Form CT-1040NR/PY or Form CT-1040X. Specific Instructions as it appears on your Connecticut income tax return. The name and Social Security Number SSN entered first on the joint tax return must also be entered first on Form CT- 8379. Remember to check the box for...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct 8379 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 8379 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 8379 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ct 8379 tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out ct 8379 form

How to fill out ct 8379:

01

Obtain a copy of form CT 8379, which is the Nonobligated Spouse Allocation for Connecticut tax purposes.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box - either married filing jointly or married filing separately.

04

Provide information about your spouse, including their name, Social Security number, and income.

05

Calculate the allocated amount of any Connecticut income tax payments or refunds that should be applied to each spouse by following the instructions on the form.

06

Attach any required supporting documentation, such as a copy of your federal tax return, Schedule CT-SI, or any other required schedules or forms.

07

Sign and date the form, and mail it to the Connecticut Department of Revenue Services using the address provided on the form.

Who needs ct 8379:

01

Individuals who are married and filing separately in the state of Connecticut may need to file form CT 8379.

02

This form is specifically for the nonobligated spouse, meaning the spouse who is not responsible for the tax debt or obligation being addressed.

03

The nonobligated spouse may need to fill out form CT 8379 in order to allocate tax payments or refunds between themselves and their spouse.

04

Filing form CT 8379 ensures that each spouse receives their fair share of any Connecticut income tax payments or refunds.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of ct 8379?

CT 8379 is a Connecticut Department of Revenue Service form used to report the estimated income tax of individuals and non-resident individuals (sole proprietors, partners, S corporation shareholders, and beneficiaries of estates and trusts). This form is used to help taxpayers calculate their estimated tax liability for the tax year.

What is the penalty for the late filing of ct 8379?

The penalty for the late filing of Form 8379 is up to 25% of the amount of the refund, or $5,000, whichever is less.

What is ct 8379?

Form 8379 is an IRS tax form used to claim Injured Spouse Allocation. This form is filed by a taxpayer who is married but wants to protect their portion of the refund from being used to offset the debts owed by their spouse. By filing Form 8379, the injured spouse can potentially receive a portion of the refund.

Who is required to file ct 8379?

An injured spouse or an injured spouse claimant is typically required to file Form 8379, Injured Spouse Allocation, with their joint tax return when they believe their portion of the joint overpayment may be applied against their spouse's past-due federal tax, state income tax, child or spousal support, or federal non-tax debt. This form helps protect the injured spouse's share of the refund.

How to fill out ct 8379?

To fill out Form CT-8379, Injured Spouse Allocation, follow these steps:

1. Start by downloading the form from the official website of the Connecticut Department of Revenue Services.

2. Provide your personal information and your spouse's personal information in the top section of the form. This includes names, Social Security numbers, addresses, and phone numbers.

3. Part I: Indicate your filing status by selecting either "Married Filing Joint" or "Married Filing Separate" in Box 1.

4. Part II: This section requires you to allocate income and deductions between you and your spouse. This is done to determine the share of the refund that belongs to the injured spouse. Follow the instructions in the form to accurately divide income, deductions, and exemptions.

5. Part III: If you are claiming an allocation of a state refund, check the box and provide the requested information.

6. Part IV: Sign and date the form. If filing jointly, both spouses must sign.

7. Mail the completed form to the address provided on the form, along with any other required documentation or supporting forms. Make sure to keep a copy for your records.

Please note that Form CT-8379 is specific to Connecticut state filings. If you need assistance with federal or other state tax forms, consult the respective authorities or seek professional help.

What information must be reported on ct 8379?

The IRS form 8379, Injured Spouse Allocation, is used to request the allocation of an overpayment of taxes between two spouses when a joint overpayment was applied to a past-due obligation of one spouse, for example, child support or student loans. The form requires the following information to be reported:

1. Personal Information: You need to provide your name, address, social security number (SSN), and your spouse's name and SSN.

2. Filing Information: Indicate your filing status (married filing jointly), the tax year for which the overpayment occurred, and the date you filed your joint tax return.

3. Allocation of Refund: Specify the amount of the refund you are claiming as the injured spouse, and the portion of the refund that should be applied to your spouse's obligation. Also, report any income, exemptions, and other credits that are specifically attributable to you.

4. Obligations of the Spouse: Provide details about your spouse's federal non-tax obligations (such as child support, state income tax, state unemployment compensation debt, etc.) for which the overpayment was applied.

5. Signature: Both spouses must sign and date the form.

Additionally, you should attach a copy of your joint tax return and any supporting documents related to your spouse's obligations and your income/exemptions.

It is always recommended to consult with a tax professional or refer to the official IRS instructions for accurate and up-to-date information before filling out any tax forms.

How can I get ct 8379?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ct 8379 tax form and other forms. Find the template you need and change it using powerful tools.

How do I edit fillable ct 8379 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your ct 8379, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the ct 8379 tax form electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your fillable ct 8379 and you'll be done in minutes.

Fill out your ct 8379 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Ct 8379 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.